Surprise audits can be stressful, but they don’t have to be. Organizations that take a proactive approach to audit preparation are not only more compliant but also more efficient. In this blog, we’ll outline strategies to help your organization stay audit-ready year-round, minimizing stress and ensuring compliance no matter when an audit arises.

1. Maintain Consistent and Organized Documentation

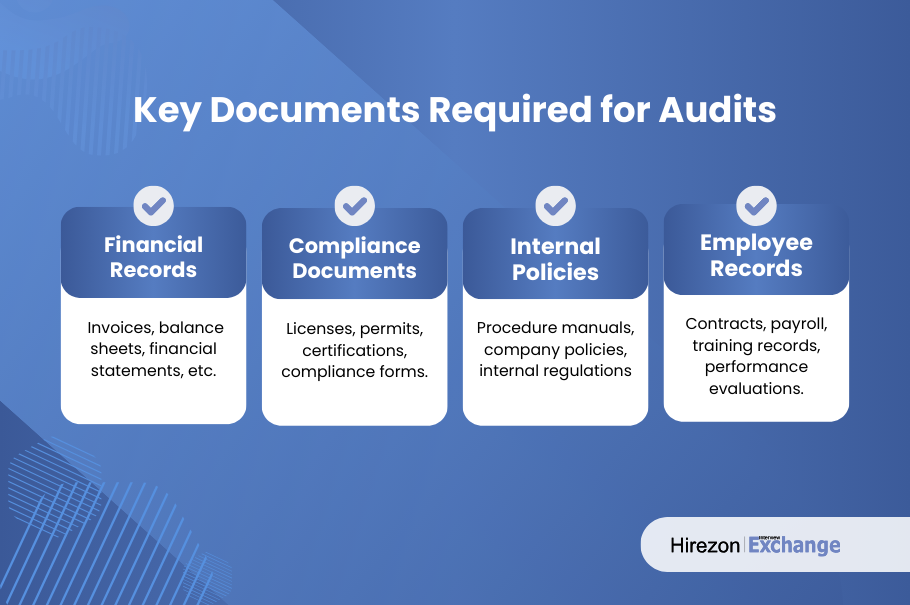

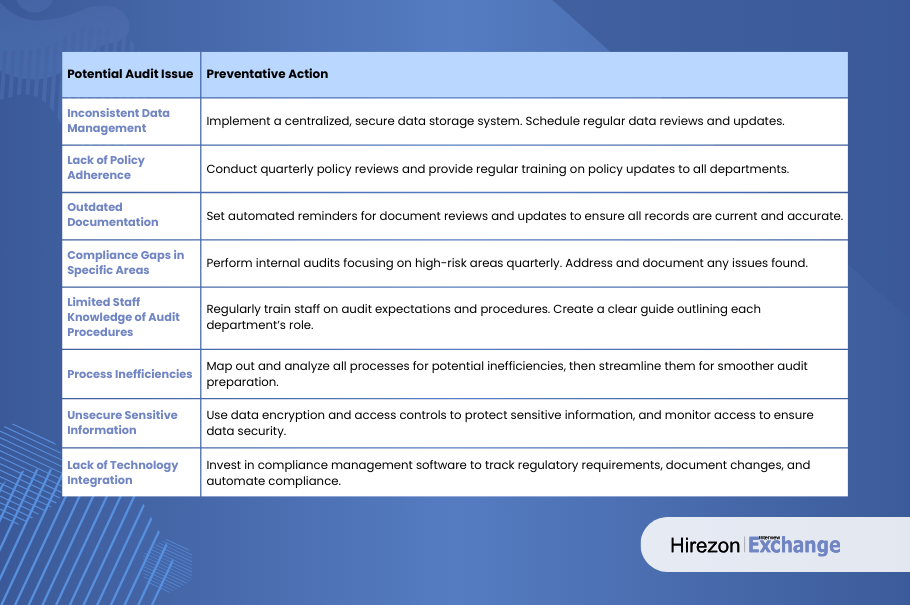

One of the most critical aspects of audit preparation is maintaining organized and consistent documentation. Documentation should be up-to-date, accessible, and secure. This includes financial records, compliance documents, employee records, and any other data that might be relevant in an audit.

Tips for Effective Documentation:

- Regular Updates: Schedule regular updates for important documents. Quarterly reviews can ensure that you always have current data.

- Centralized Storage: Use a centralized system to store all documents, ensuring quick access when needed.

- Security Measures: Protect sensitive information through encryption and access controls to ensure data security.

2. Regularly Review Compliance Policies

Laws and regulations are constantly changing. By staying up-to-date on industry standards and regulatory changes, your organization can avoid falling out of compliance.

How to Keep Policies Updated:

- Quarterly Policy Reviews: Conduct quarterly reviews of all compliance policies to ensure they align with current regulations.

- Assign Responsibility: Designate a compliance officer or team responsible for tracking changes in regulations and updating policies as needed.

- Industry Alerts: Subscribe to regulatory news from relevant agencies or organizations to stay informed about new and updated requirements.

3. Implement Internal Audits to Identify Weaknesses

Conducting regular internal audits helps your organization identify potential issues before they become major problems in an external audit. These audits provide an opportunity to address any areas of concern early on.

Best Practices for Internal Audits:

- Plan Ahead: Schedule mini-audits throughout the year, focusing on specific areas each time.

- Involve Multiple Departments: An effective audit covers all departments. This helps identify compliance gaps and ensures that every area of the organization meets audit standards.

- Use a Standard Checklist: Create a checklist based on past audit results or regulatory requirements to standardize internal audits.

4. Train Your Team on Audit Expectations and Procedures

Everyone in the organization plays a role in ensuring compliance. Regular training sessions can ensure that each department understands their responsibilities, from record-keeping to process compliance.

Key Areas for Training:

- Document Management: Ensure team members understand the importance of accurate, up-to-date documentation.

- Policy Awareness: Make sure each department understands the specific policies that impact their work.

- Audit Procedures: Familiarize teams with what an audit entails and the role they play in providing the necessary information.

5. Leverage Technology to Track Compliance and Document Management

Utilizing technology can streamline audit preparation and ensure data accuracy. Many software solutions offer features like automated reminders, data tracking, and real-time compliance monitoring to simplify the process.

Benefits of Technology for Audit Readiness:

- Automated Tracking: Set up automated reminders for policy reviews, document updates, and other audit-related tasks.

- Centralized Data Storage: Store all documents in one secure, digital location for easy access.

- Real-Time Monitoring: Use tools that provide real-time insights into compliance status across the organization.

Preparing for surprise audits doesn’t have to be overwhelming. By implementing proactive strategies such as organized documentation, regular policy reviews, internal audits, employee training, and the use of technology, your organization can stay audit-ready year-round. This not only reduces stress but also enhances efficiency and helps create a culture of compliance.